It is believed that having multiple streams of income may be the secret to building resources. That is not entirely wrong, but it’s not the whole story. Just bringing in the cash isn’t enough; knowing how to use it objectively is. Many people start with good intentions but end up overwhelmed.

Without informed guidance, juggling different income sources may feel exhausting. It’s like trying to carry water in a sieve. That’s where solid financial insights come into play. With educated insights, it may be easier to make informed decisions.

In a world where investment opportunities are at every turn, having access to suitable tutors and education may help make sense of it all. Monstean connects people with education firms that provide relevant investment training. What’s more, Monstean is free to use!

Monstean has connections, and we’re not afraid to share them. Monstean connects learners with educators. It’s simple: Monstean brings together those who want to learn and those who teach. With Monstean, learning becomes a shared journey.

Everything needed to learn about finance is in one place. No need to jump around. We bring access to all these resources. Monstean makes accessing financial education simple and stress-free.

At Monstean, we make it easier to find the apt fit. Even in the face of language barriers, Monstean is here to help every step of the way.

At Monstean, everything is free. It brings learners and educators together at no cost, and anyone can access education firms without opening their wallet.

At Monstean, it’s all free, all the time. We believe in access to investment education for all. Monstean sets people up to gain knowledge and develop. Monstean keeps things easy and light without asking for a penny!

At Monstean, the process is smooth and straightforward. With just a few clicks, users are signed up instantly. Only a name, email address and contact details are needed to sign up. Monstean is designed to help people learn without having to wait around.

Finding a suitable education firm is crucial. Monstean helps identify firms that align with specific needs and goals. Monstean uses the provided information to match individuals with firms that align with their interests and goals.

A representative is always on standby to assist. As soon as a match is made with an education firm, someone from that firm gives a call. They serve as a guide through the whole process. Plus, it’s nice to know there’s always a friendly voice on the other end.

Ever thought about going against the crowd? That’s what contrarian investing is all about. When everyone else is selling, contrarians see a chance to buy at a discount. When the market is excited, they think it’s time to sell.

This style isn’t for the faint of heart. Buying when others are selling and selling when others are buying may require a lot of patience and a cool head. Sometimes, it may feel like swimming upstream. But it might pay off big when the market catches up. Contrarians think differently. They trust their research and make bold moves. It’s all about sticking to the plan, even when things look tough. Get to learn more about this after signing up on Monstean.

Gross Domestic Product (GDP) is like the report card for a country’s economy. It shows the total value of everything a nation produces, from goods to services, in a year. A high GDP means the economy is humming along nicely.

A low GDP may signal trouble ahead. GDP is often used as an indicator of a country’s economic health and development. Monstean can help learners get deeper into understanding GDP and how it shapes economies. How? By connecting individuals to firms that teach about such concepts. Here are six key things one can learn about GDP after using Monstean;

This is what people spend on everyday things like food, clothes, and healthcare. It’s the biggest part of GDP. Monstean connects learners with firms that break down consumer behavior.

Investment is when businesses spend resources to develop. This could mean buying machines or building offices. When companies invest, jobs may be created. The economy may develop, too. Monstean connects learners with firms that explain these moves.

Government Spending

A lot of things keep the economy running. Government spending is one of the biggest. This includes funds spent on schools, roads, and healthcare. Government spending focuses not just on numbers but on how it shapes the country. Use Monstean to discover more.

Nominal vs. Real GDP

Nominal GDP shows the value of everything at today’s prices. After using Monstean, get to learn how Real GDP adjusts those numbers for inflation. This way, it may show the actual increment without price changes messing things up.

Net Exports

Net exports are all about trade. It’s the difference between what a country sells and what it buys. When a country sells more than it buys, it may boost GDP. Global trade can shape economies in big ways.

A country making returns from exports may help its economy develop. If imports are higher, things may slow down. Monstean connects learners with firms that explain these trade trends.

This metric gives an idea of how resources are created for each individual in a country. It tells the story of a country’s financial health.

When things don’t go as planned with an investment, selling it for a tax break may sound smart. However, the wash sale rule prevents investors from selling a lost stock and buying it back promptly. If the same or similar stock is bought within 30 days, the tax loss can’t be claimed.

It’s like trying to have the cake and eating it too. The IRS won’t let that happen. Instead, the loss gets added to the cost of the new stock. This rule stops people from getting quick tax advantages without actually changing their position.

The wash sale rule only delays the tax break until the next time that investment is sold for good. It is believed that this rule may keep investors sharp. Want to know more? Why not sign up for free on Monstean?

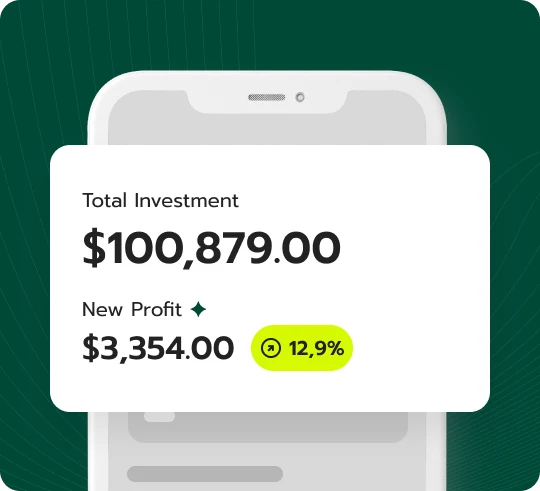

The plan to retire at fifty may sound amazing, but it needs solid savings. That’s where SEP IRAs could come in. It may be a probable choice for self-employed individuals and small business owners. They may provide a high contribution limit compared to regular IRAs. They are a flexible way to save for retirement.

With SEP IRAs, business owners can set aside a good chunk of their income each year for retirement. However, nothing is certain with finances. Getting there means making cash work harder than it’s being spent. This could involve cutting expenses or making more informed decisions. Monstean connects learners to firms that break it all down. Key elements of SEP IRAs include:

SEP IRAs let people put in more funds than a regular IRA. It may help build up a retirement stash. The plan is flexible. Contributions can change year by year based on income.

The funds put in are tax-deductible. This means less taxes to pay temporarily. While the fund sits, it increases without being taxed. Once retirement hits, it can be withdrawn. At that point, taxes apply. But until then, all increments are tax-free.

Contributions can change every year. This makes it easy to adjust based on income. When business is good, saving more may be simple. If things slow down, it’s okay to save less. This flexibility may help plan for the long term.

Who can use it? Self employed folks and small business owners can. It’s one way to build up retirement savings. No complicated rules. Just more savings with flexibility.

Many times, people hear about emerging markets but may not fully understand what they are. These are countries with expanding economies like India, Brazil, and Russia. They’re not as developed as the U.S. or Europe. But their industries are developing fast. This means there may be prospects for investors.

These economies expand quickly but can be unstable, too. It’s a high-risk, high-reward game. That’s why it’s important to understand them first. Connect with firms that would teach without leaving anything out. Want to learn more? Learn via Monstean. Sign up for free!

Ever heard the saying, “Splitting hairs”? A stock split is kind of like that but with shares. When a company’s stock price gets too high, it might split its shares. This means existing shares are divided into more shares.

For example, a 2-for-1 split turns each share into two. The total value stays the same, but more shares are now available at a lower price. Stock splits may make shares more affordable.

This doesn’t change the company’s overall value. Just the number of shares and the price per share. Want to understand how stock splits fit into investments? Monstean connects people to firms that have all the details. Sign up on Monstean for free. Get connected and grasp the knowledge needed to make informed decisions.

The feeling of losing resources may hurt more than the pleasure of gaining the same amount. This is called “loss aversion”. It causes people to avoid risks, even if the rewards could be higher. For example, losing $100 hurts more than finding $100 feels great. This mindset may lead to poor financial decisions and missed prospects for advancement. Sign up for free on Monstean to understand more.

People often shy away from investments to dodge possible losses. Even when there may be a chance for bigger returns, fear holds them back. This may lead to missed chances for prospects.

Losses trigger stronger negative emotions compared to positive feelings from gains. The pain of a loss sticks with people longer. This emotional reaction can cloud judgment.

People often keep bad investments, hoping they’ll recover. This hope can cloud their judgment. Instead of cutting their losses, they wait for a turnaround. The SML (Security Market Line) may help fine-tune portfolios. It tells investors how to balance their investments to get the ideal returns for their risk level.

Investors tend to hold onto losing stocks, hoping for a rebound. This waiting game can be harmful. Stocks may not recover as expected.

Fear of losing can push prices down too far. When investors panic, they may sell quickly to avoid losses. This rush to sell causes prices to fall even more.

People may save too conservatively, missing possible returns. Over time, this cautious approach may hold back financial expansion.

Use Monstean to loosen the knots around financial matters. Investors aren’t the only ones that need to learn about finances. Whether it’s understanding investments or learning how to increase savings, Monstean connects users to firms that simplify finance. It’s the place to get access to firms with insights on financial strategies. Want to make informed financial moves? Sign up for Monstean, get connected, and start learning!

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |